By Arman Bristed

The market for U.S. Treasury Bonds is receiving more attention recently. The value of the dollar tends to drop when long-term Treasury bonds decline in price. The March 2009 report of the Fed's Flow of Funds shows that there is $14.5 trillion outstanding in mortgage-backed securities, agency securities and Treasury securities. Foreign countries are heavily invested in

Foreign countries are heavily invested in With the consequence of huge deficits and out of control government spending, the real value of U.S. Treasury securities are the focus of increased attention.

If

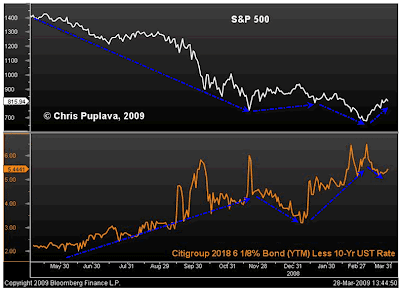

If Normally, high interest rates is associated with the central bank as the government attempts to ward off inflationary pressures that come with an expanding money supply. Yet, there is less demand for Treasuries and the only other viable option is to have higher interest rates to entice buyer demand. Unfortunately, higher interest rates would only further decline the economy. As the result of higher interest rates, a greater burden is placed on the citizen which results in an escalation in mortgage defaults and more consumer debt.

The current administration's record-breaking plans to fund the deficit and the Fed printing out dollar bills to buy the debt is staggering. The U.S. Treasury is pushing the yield on bonds even higher and the floodgates are open. Some economists are wondering who is going to be purchasing these bonds.

Inflationary deficit spending can destroy a nation. The renowned late economist, Milton Friedman warned that "Inflation is a disease, a dangerous and sometimes fatal disease that, if not checked in time, can destroy a society."

About the Author:

Story by http://retwt.me/ce6p

Tags: Market